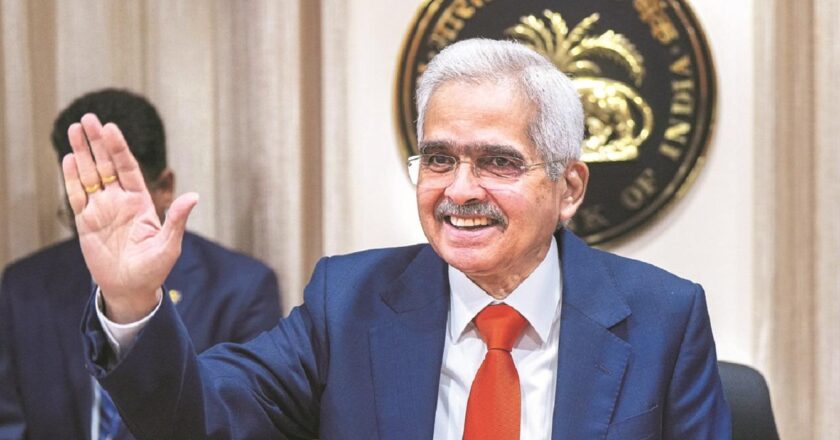

India’s outward FDI falls 12.14% to $1.88 bn in October: RBI data

Reflecting slack in global economic growth, India’s outward foreign direct investment (FDI) commitments fell by 12.14 per cent sequentially to $1.88 billion in October, compared to over $2.14 billion in September. They also saw over $2.66 billion in October 2022, according to Reserve Bank of India (RBI) data.

Outbound FDI, expressed as a financial commitment, comprises three components: equity, loans, and guarantees.

A slowdown in economic and business activities, especially in developed markets, has impacted direct investment flows, both inbound and outbound. Most investments (outward FDI) are in subsidiaries or stakes in foreign companies. A slowdown in the developed markets means fewer opportunities, according to bankers.

Just like the weak outbound FDI numb...