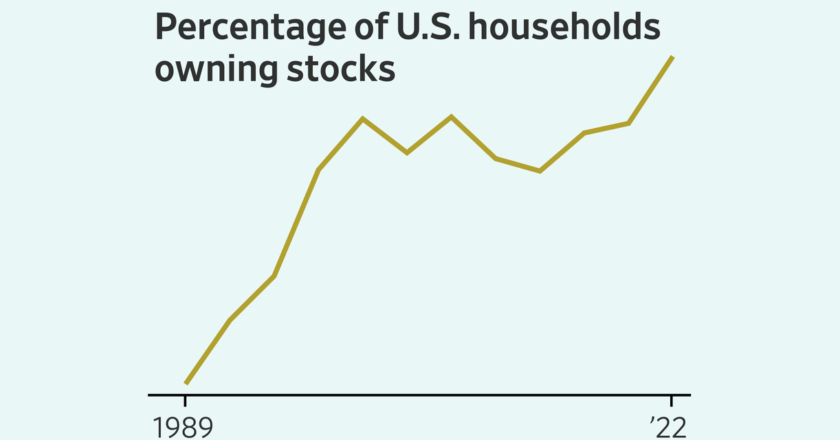

More Americans Than Ever Own Stocks

Listen to article(2 minutes)The share of Americans who own stocks has never been so high.About 58% of U.S. households owned stocks in 2022, according to the Federal Reserve’s survey of consumer finances released this fall. That is up from 53% in 2019 and marks the highest household stock-ownership rate recorded in the triennial survey. The cohort includes families holding individual shares directly and those owning stocks indirectly through funds, retirement accounts or other managed accounts.Copyright ©2023 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8