Xenophobia Drives Foes of Nippon Steel’s Deal

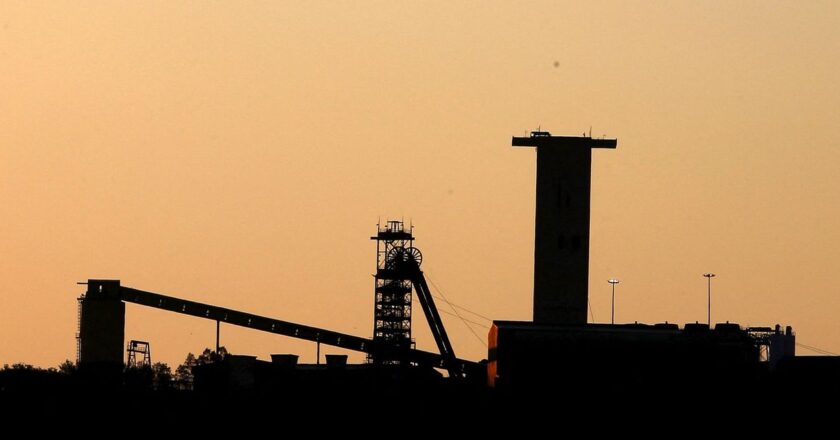

Election-year jitters have the Biden administration and a few swing-state members of Congress from both parties parroting union concerns about Nippon Steel’s takeover of U.S. Steel. The United Steelworkers union favored Cleveland-Cliffs’s offer, which was almost 50% lower than Nippon’s $14.1 billion bid. There is no real cause for concern other than xenophobia and the damage it could do to Cleveland-Cliffs’s position as the sole U.S. producer of electrical steel for transformers and electric vehicles. The rest is imported.Nippon’s steelmaking is at least as advanced as U.S. Steel’s, so technology export control isn’t an issue. National security could be a concern if American mills were shutting down due to unfairly subsidized Japanese exports to the U.S. But Nippon never used gimmicks to ...