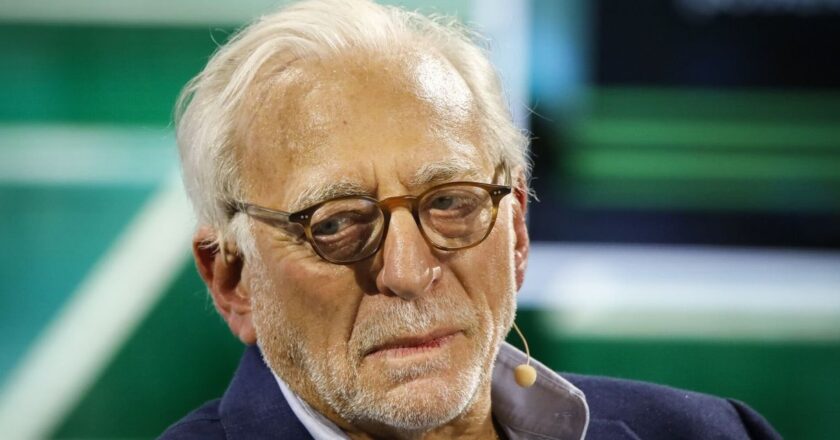

Nelson Peltz Resigns From Wiesenthal Board Over Its Ben & Jerry’s Tweet

Billionaire investor Nelson Peltz resigned from his position at the Simon Wiesenthal Center after the Jewish organization urged people not to buy Ben & Jerry’s ice cream.Peltz, who is a board member at Unilever, Ben & Jerry’s parent company, stepped down from the center on Dec. 12, according to people familiar with the matter. His firm, Trian Fund Management, is a Unilever shareholder.Copyright ©2023 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8