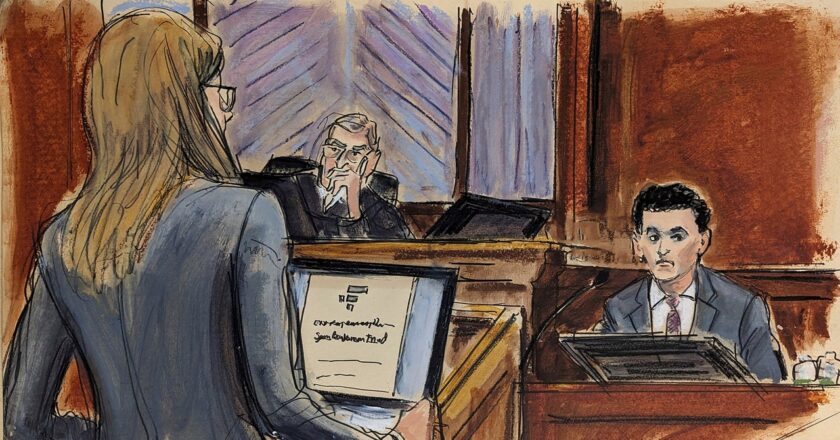

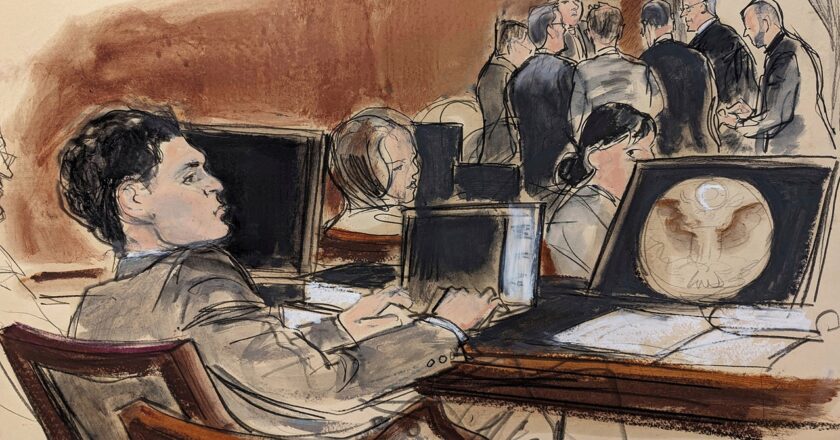

Sam Bankman-Fried Has Been Found Guilty of Fraud

The US Department of Justice (DoJ), says Estes, will consider Bankman-Fried’s conviction a “signature victory,” as its first high-profile crypto scalp. Cryptocurrency has been used for more than a decade to conceal payment for illicit products, enable extortion-based cyberattacks and launder the proceeds of criminal activity. In 2021, the DoJ announced the formation of a specialist crypto enforcement team, to “tackle complex investigations and prosecutions of criminal misuses of cryptocurrency,” it said. But until now, the agency had secured few landmark convictions.Though he was charged with old-fashioned fraud, Bankman-Fried was crypto royalty, which lends his conviction a symbolic importance, says Estes. The DoJ, she says, has sent “a message to the crypto industry that fraud and wheel...