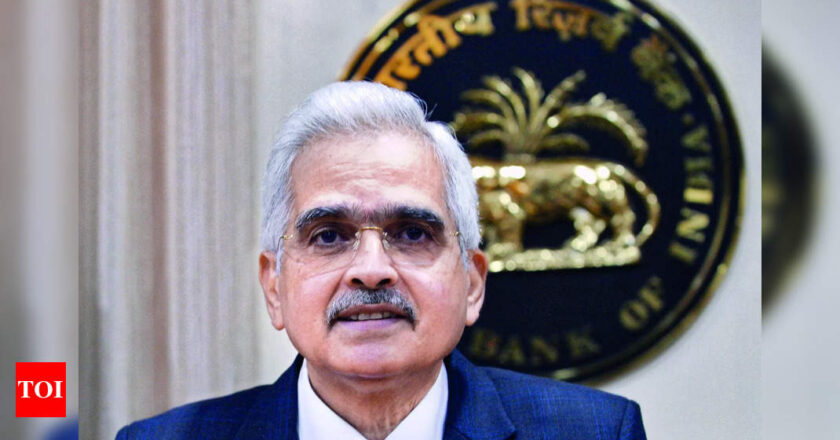

RBI Governor Shaktikanta Das: ‘Managed to rein in inflation without losing growth focus’

NEW DELHI: RBI governor Shaktikanta Das has said that the central bank managed to moderate inflation without compromising on its growth focus. In his new year message to the central bank's staff, Das said that the RBI has navigated multiple challenges faced by the economy and exhorted the staff to improve the quality and efficacy of service delivery.While pointing to the challenges posed by macroeconomic and geo-political shocks, the governor also highlighted the threat of climate change. "As Team RBI, we have been able to effectively navigate through the multiple challenges faced by us. We continued our journey with a proactive, pragmatic and prudent approach," Das said in his year-end message to RBI staff."On the monetary policy front, we have managed to moderate inflation, without losi...