By Andy Mukherjee

India’s mission to bring its vast workforce into formal jobs is faltering, leaving a majority of nonfarm labour in unincorporated businesses. It isn’t just tax evasion that’s prompting employers to keep workers under the radar. Therefore, putting more transactions under the government’s scanner — via the digital trail of a goods and services levy — may not be the solution it’s cracked up to be.

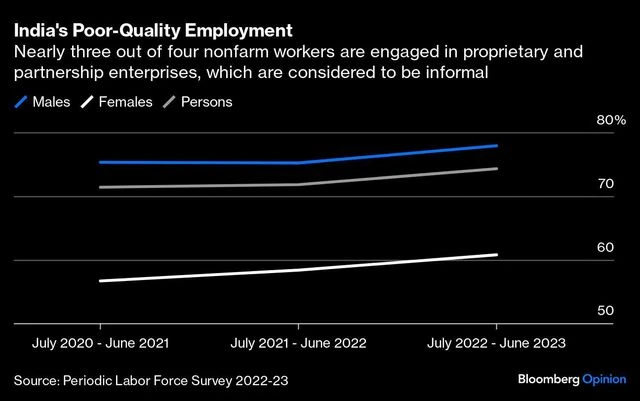

The most recent Periodic labour Force Survey shows that 74 per cent of nonfarm workers are in proprietorships and partnerships, officially classified as informal-sector enterprises. Between July 2020 and June 2021, when India battled multiple waves of Covid-19, the number was three percentage points lower. A reopened economy may have brought back livelihoods; it doesn’t appear to have made a dent into precarity.

Some part of self-employment is no doubt richly remunerated and voluntary. It’s undertaken by people with professional expertise, for instance in law, consulting or creative fields. Still, in a country where the working-age population has swelled to nearly 1 billion, this upper tier of informality is unlikely to be a significant factor.

)

This must change. By 2050, India will still be relatively more youthful than today’s advanced economies. Even so, its elderly population would more than double to 350 million. While there is still time, this cohort must break out of low-productivity work that offers no chance to save for old age or medical emergencies. If it doesn’t, it would become a drag on the tax resources of a smaller group of future workers.

Japan confronted serious aging when it was already rich. China seems to have lost steam a little sooner. What kind of a future the most-populous nation will secure before its demographic advantage fades may come down to how quickly it can replace informal and poor-quality work.

Trouble is, policymakers are relying on a 2017 goods and services tax to do the job. To them, higher revenue collections mean a more formal economy. And vice versa. However, in trying to maximise their take, they have made the GST extremely complicated.

)

The Modi government’s other strategy for formalizing the economy is industrial policy. A generous five-year package of $24 billion in production-linked incentives awaits those who put up factories. By September last year, the program had managed to create fewer than 200,000 jobs, according to the government’s own statistics. This is when 40 million Indians are enrolled in higher education.

The insecurity bred by a high degree of economic informality is making even some PhDs and engineers compete to become general factotums in a government office somewhere. At least, they will get stability of tenure and retirement benefits. Modi’s political opponents have pounced on voters’ unease by promising to bring back a fiscally ruinous defined-benefit pension. To squander two decades of progress in making workers contribute to their superannuation, and return to guaranteeing half of their last-drawn pay, will create a burden on future taxpayers. It will also curb welfare funding targeted at the bottom of the economic pyramid.

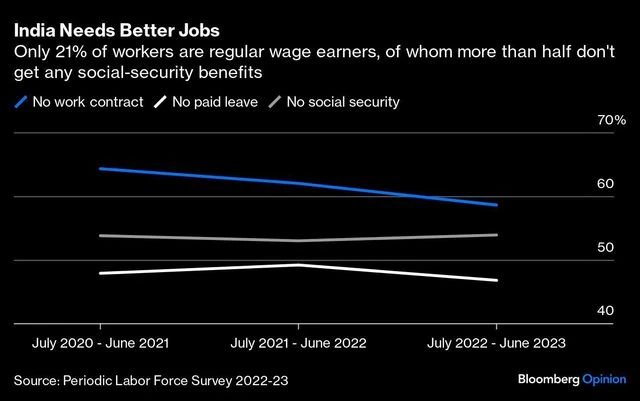

There is a very large gap between an Instagram lifestyle — to which the youth in even remote villages and small towns now aspires to — and jobs that come without proper contracts, paid leave or social-security benefits. This isn’t a disconnect that will go away because India is the world’s fastest-growing major economy.

Informality is chronic, partly because of how the job market treats two large but highly disadvantaged groups. Women struggle to find formal work close to home so they can balance its demands with household chores. Social norms (and safety concerns) curb physical mobility. Meanwhile, Dalits, the caste groups at the bottom of a repressive, hierarchical ladder, are stuck in casual, daily-wage work. In 76 per cent of the cases, the vicious cycle is repeating for the next generation. Stunted economic mobility is the problem.