When asked to rate the national economy, some people base it on how they’re doing financially or what they experience themselves. That might seem odd at first, since they’re just one person in a multi-trillion-dollar economy. But the personal lens is often the most salient one we have into the bigger abstract forces at work. For most of us, it’s bills and budgets that we pore over at the kitchen table — not the latest Fed briefing.

Inflation’s impact really spotlights this phenomenon today. It’s been the top reason people give for their negativity about the economy — and prices, which are the chief complaint, and which haven’t abated even as the inflation rate slowed because many of the prices that spiked up after the pandemic have stayed much higher than they were before it. The latest CPI report just released only added to those increases.

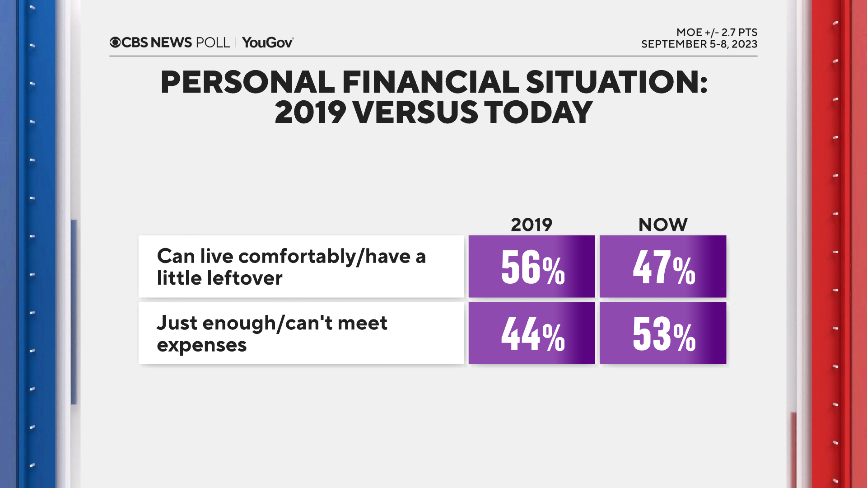

Given that, the pandemic makes a good time-point marker to gauge recovery on people’s personal finance scale, comparing just how different things are for them now compared to before the pandemic. And when we do, we see what we might call a lagging personal recovery.

Today the number of people describing themselves as “living comfortably and able to save” is still lower than it was in the summer of 2019, before the pandemic hit. And the number who describe themselves a notch below that, meeting expenses with a little left over — that’s lower, too. Taken together, these items are a rough proxy for the idea of “getting ahead,” and they’re not nearly back to pre-pandemic levels.

And in turn, more people report struggling today than did then: half of Americans says they’re either just meeting, or cannot meet, their expenses. Those tougher descriptors are together nine points higher than summer four years ago. That amounts to millions of people.

This has the implications we’d expect for the national economy ratings. Both today and four years ago, the better people say they’re doing, the better they rate the national economy, and the worse they are, the worse they think it is.

There’s an especially dramatic change in how the middle income range describes themselves doing today. Just over half of those in the income bracket of $50,000-$100,000 say they’ve at least got something left over after expenses — and that’s down nineteen points from what that income range said in 2019.

We might have expected big change in the lower income bracket of under $50,000, too, given that prices are absolute, but in fact there wasn’t much. Perhaps because so many were already struggling: both now and in 2019, it’s only a third under $50,000 who say they’ve got something left over after expenses.

(There admittedly might be other factors here with income and expenditures that this particular measure won’t pick up. Perhaps people have collectively adjusted their expenses in the interim to whatever extent they could. Or they may have taken on debt to pay them, which has increased of late. Lower expenses might make these figures actually look more stable over time, but then standards of living might have gone down, perhaps spurring negative views in either case.)

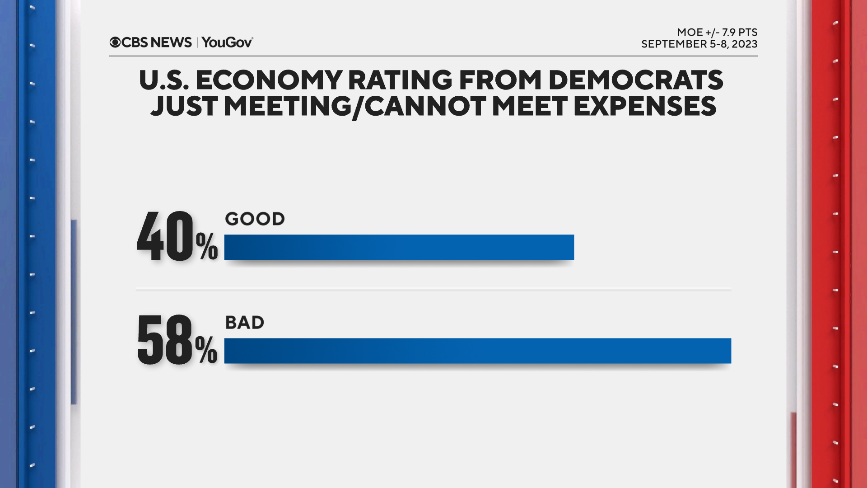

A final note, with more political implications for all this: People just getting by or struggling financially today give far worse ratings of the U.S. economy than did the people who were in the same tough positions back in 2019. But here the reason lies not so much with the pandemic as it does with partisans.

When Democrats are just getting by or struggling today — and a sizable portion of them are — those Democrats are critical of the national economy, even though their party is in the White House. But back in 2019, any struggling Republicans at the time were not nearly as critical with their own party in power. Such Republicans are certainly critical today.

That, in turn, is one reason that President Biden’s economy and inflation ratings are staying low. He’s not getting the kind of overwhelming within-party approval one might expect in this hyper-partisan era.

And so, by many macro numbers, the U.S. economy may be recovering from the impact brought on with the pandemic. But at least on this basic and personal assessment, things simply are still not back personally for a lot of people.

This CBS News/YouGov survey was conducted with a nationally representative sample of 2,335 U.S. adult residents interviewed between September 5-8, 2023. The sample was weighted according to gender, age, race, and education based on the U.S. Census American Community Survey and Current Population Survey, as well as past vote. The margin of error is ±2.7 points.