By Andy Mukherjee

Should India double down on software services, where it has proven prowess and strong outsourcing companies? Or must it follow the successful East Asian model and bet big on factory work to generate mass employment? Maybe there is a third way.

The manufacturing versus services debate has taken a fresh urgency. For the first time, some of the iPhones that customers bought on the launch date of the new model last month were made in the most-populous nation. To policymakers, it vindicates the $24 billion that Prime Minister Narendra Modi’s administration is spending over five years to promote India as the next China.

However, to critics, giving Foxconn Technology Group and other Apple suppliers generous subsidies to assemble phones is not necessarily a pathway to making their high-value components — not when the incentives come laced with a protectionist turn in trade policy. The handouts have so far failed to bridge the competitiveness gap with Vietnam, let alone the People’s Republic.

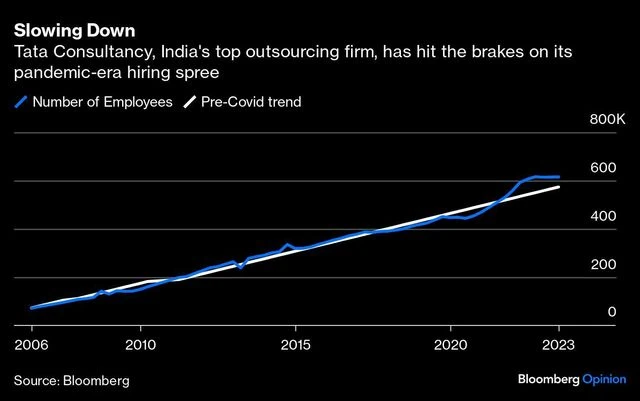

Still, services don’t seem to be a road to salvation, either. India’s outsourcing capabilities may have hit a limit. Big homegrown players like Infosys Ltd. have slashed growth forecasts. Tata Consultancy Services Ltd., which had grown by 172,000 people in nine quarters during the pandemic, has hit the brakes on recruitment. One reason could be an uncertain outlook for global growth and interest rates, a repeat of the slowdown witnessed during the 2012 European debt crisis.

Between manufacturing and services, there is a middle path. It may not lead to the 70 million new jobs the economy needs over a decade, but it could help garner much more value per employee than either assembling electronics or selling software as a remotely produced service. This third way is software products.

)

For a case study, take Planview Inc. If it were an outsourcing specialist, there would be nothing remarkable about its modest campaign to hire about 500 engineers in Bengaluru. After all, writing code for clients — and getting paid for time and effort — has been the southern Indian city’s calling card since it burst into global prominence during the Y2K scare.

Planview, however, isn’t a service provider. As Chief Executive Officer Razat Gaurav describes it, the Austin, Texas-based firm sells a layer of “connective tissue” to the likes of Ikea, the World Bank, and 59 of the world’s largest 100 firms that use the platform. The product helps join up fragmented corporate data, all the way up from disconnected spreadsheets to the popular, cloud-based software on which large multinationals are spending billions. It helps firms get the most out of tools like Jira, GitHub, ServiceNow and DevOps, and cuts wastage rates that can be as high as 40% in digital innovation.

That’s what makes Gaurav’s choice of location an interesting one. Starting in the early 1990s, behemoths like HP Inc., International Business Machines Corp., Oracle Corp., Intel Corp., Microsoft Corp., Adobe Inc. and Alphabet Inc.’s Google have tapped India for research and development. However, Planview, which TPG Capital LP and TA Associates acquired in 2020 for $1.6 billion, is tiny. The 34-year-old, profitable firm never really felt the need to expand aggressively outside the US. But now Gaurav, who was brought in by the new owners, has beefed up the 650-person strong workforce he inherited to 1,400, including 500 engineers in Bengaluru.

And it isn’t because the CEO is himself Indian-born, but because the country has, of late, emerged as a meaningful market for business-to-business sales. Of the $2 trillion that global corporations are spending on digitization, India Inc.’s share is around $85 billion, Gaurav says. Expect it to grow. Thanks to a collapse in data costs since 2016, retail customers are now all online. The rising expectations of 1.4 billion people can no longer be met by organizations that aren’t themselves at the cutting edge of employee productivity and customer engagement.

Planview is just one of the 1,580 overseas firms setting up so-called global capability centers in India. The “service” that these captive units provide to their parents is not traditional outsourcing. As much as 56% of their $46 billion of annual output is from engineering R&D, which gets embedded into the core product sold around the world, repeatedly. While some multinationals are increasing the range of services of their India centers, others — like Novartis AG, Diebold Nixdorf Inc., Boeing Co. and Airbus SE — are “crossing over into manufacturing,” says Pranjul Bhandari, a HSBC Holdings Plc economist in Singapore. In other words, manufacturing versus services may be a false binary choice.

Starting wages in the outsourcing industry haven’t budged in two decades. Translated into dollars, they have fallen by half. With 42% unemployment among college graduates under 25 years of age, it will be a double whammy if new technology cuts freshers out of the equation. However, a product that embraces conversational AI will still need scientists to train models on supplemental data and engineers to design prompts that extract insights, make predictions and initiate actions.

For instance, a banker falling short of her target for the quarter can ask her Planview digital assistant to suggest a way out. If the advice — in conversational English — is to delay a credit-card launch, the software could even help carry out the change, and inform the CEO. Behind the scenes, there will be plenty of highly paid work. “None of this talent is of the outsourcing variety,” Gaurav says.

In labor-cost arbitrage, AI will be hard to beat. And while global manufacturers’ quest to rely less on China will get its rival economy a toehold in assembly operations, it will be low-value work. This is where the 1.7 million youngsters working for multinationals’ capability centers can make a difference. No subsidies are required for a 10-fold jump in this number. Less red tape and smoother Bengaluru traffic will be enough. If anything, the income and consumption from better-paying occupations will generate tax resources for the remaining 53 million jobs needed over the next decade. Many of them can be in healthcare, education, urban infrastructure and other neglected areas. Therein may lie India’s third way.

Disclaimer: This is a Bloomberg Opinion piece, and these are the personal opinions of the writer. They do not reflect the views of www.business-standard.com or the Business Standard newspaper