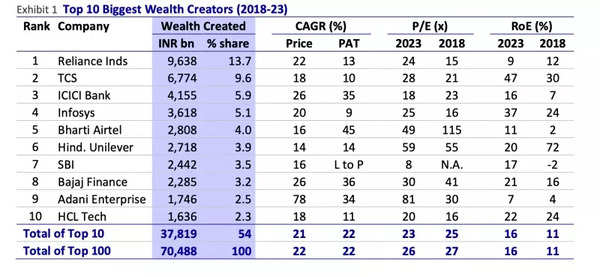

Reliance Industries has secured its fifth consecutive spot as the largest wealth creator from 2018 to 2023, marking its tenth overall No.1 position in the last 17 five-year study periods.

Top 10 Biggest Wealth Creators 2018-23

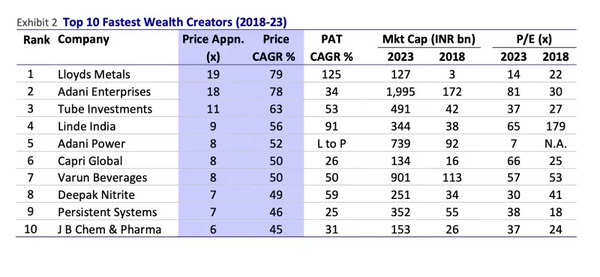

One standout performer was Lloyds Metals, which emerged as the fastest wealth creator with a compounded return of 79% on their stock during this period. An investment of Rs 1 million in the top 10 Fastest Wealth Creators in 2018 would have soared to Rs 10 million by 2023, boasting a return CAGR of 59%, far surpassing the BSE Sensex‘s 12%.

Top 10 Fastest Wealth Creators 2018-23

Capri Global, a relatively low-profile company, emerged as the most consistent wealth creator over 2018-23. It consistently outpaced the BSE Sensex in all 5 years and holds the highest price CAGR of 50%.

Top 10 Consistent Wealth Creators 2018-23

The criteria for Consistent Wealth Creators assesses stocks based on their outperformance in each of the last 5 years, says the Motilal Oswal report.

Adani Enterprises retains its title as the Best All-round Wealth Creator for the second consecutive time. The report identifies All-round Wealth Creators by summing up ranks across the three categories: Biggest, Fastest, and Consistent. In cases of tied scores, the stock price CAGR determines the All-round rank.

Top 10 All Round Wealth Creators 2018-23

Although the top 100 wealth creators in India Inc generated a total wealth of Rs 70.5 lakh crore during the 2018-2023 period, this figure is lower than the previous five-year period from 2017 to 2022.

The study also revealed that stocks with a price-to-earnings (PE) ratio between 25-30 times showed significantly higher returns compared to those with a PE ratio below 10 in the years 2018-2023. Similarly, stocks with a price-to-book (P/B) ratio between 5-6 times exhibited the highest returns.